On the surface, it might seem like drilling for oil hasn’t changed much over the years. To the average person, oil rigs look almost like they did 20 years ago and the oil itself is essentially the same substance as what has been pumped out of the ground for decades. But evolving technologies and processes have significantly altered what has gone on underground.

Let’s look at some game-changing drilling advancements that occurred over the past few decades.

Out But Not Down: Horizontal Wells Emerge

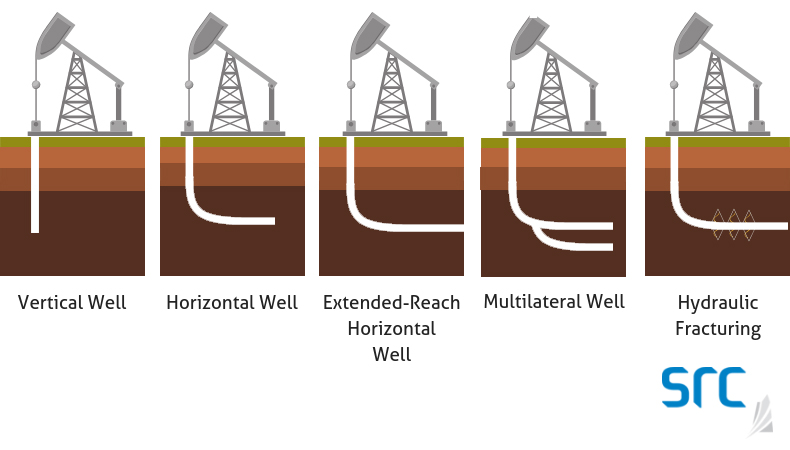

Drilling changed direction – literally – in 1987 when Saskatchewan’s first horizontal well was drilled.

SRC played a key role in developing that first well. We built a working scale model of our client’s well site and began a series of tests to see how a horizontal well could best produce oil.

From that key initiative over 30 years ago, oil producers have almost completely shifted away from vertical wells to horizontal wells. Verdazo Analytics states that, by 2012, Canadian oil producers were drilling twice as many horizontal wells than vertical wells.

The trend continues today. Almost 90 per cent of Saskatchewan wells are now drilled horizontally (also called directional drilling). Producers in the Viking oil formation, which spans the southwestern part of the province and into Alberta, have probably benefitted the most from the technology.

Over the past ten years, approximately 5,200 horizontal wells have been drilled, producing over 53,000 barrels per day (bpd). The region was only getting about 8,000 bpd from 8,000 vertical wells prior to 2007.

According to Kelly Knorr, Operations Manager for SRC’s Energy Division, “The Bakken formation, which is in the southern part of Saskatchewan and Manitoba, as well as into the United States, could not have been economically developed either without advancements in horizontal drilling.”

Why is this method better? Oil deposits are typically wider than they are deep, so drilling horizontally keeps the drill in contact with the pool longer, allowing more oil to be pumped without re-drilling.

But, Knorr notes, not all types of wells have moved in the same direction in Saskatchewan. “Cold Heavy Oil Production with Sand, or CHOPS, wells that are used in relatively shallow, thin formations are still drilled vertically.” For more about this type of production, see CHOPS: but not for your BBQ.

Go Long: Extended-reach Horizontal Wells

Not only have the number of horizontal wells grown but so has their length. Extended-reach horizontal (ERH) wells are now widespread in the oilfield. Knorr says, “With new drilling technologies and field experience, wells can be extended with less risk of holes collapsing and other problems. The incremental costs are much lower than developing a separate well.”

The total average length in Western Canada reached just over 2,800 metres at the start of 2018. That’s over two kilometers long.

Companies are seeing the benefits of ERH wells. Raging River, a key player in the Viking formation, estimated that 60 per cent of its oil wells drilled in 2018 would be ERH.

The benefit of having ERHs is that they can reduce the amount of infrastructure and footprint required to extract the oil. With a smaller footprint, oil producers can also reduce their environmental impact.

However, with longer drilling distances comes unique challenges. Adding more wells increases the complexity of the project. Specialized equipment is required, and modelling and prediction is often more challenging.

Off In All Directions: Multilateral Wells

An added benefit of drilling horizontally in one direction is that it’s then possible to drill in another direction from the same platform. These multilateral wells can produce more than four times the crude than conventional horizontal wells and can reduce production costs substantially.

Eliminating the need for just one additional platform can save millions of dollars in development costs, but multilateral wells are more costly and complex.

However, challenges remain, particularly for onshore wells. Knorr says the multiple wellbores must be sealed and selectively accessible through the joints (or side connections), which is not easy to design.

Further, the equipment needed for well completions is complex, which can be expensive. Nonetheless, multilateral well design and technology continue to develop, with applications being extended throughout the industry and costs becoming more economical.

Let’s Get Cracking: Hydraulic Fracturing

Hydraulic fracturing or fracking, is a drilling method that injects a highly pressurized slurry of sand, chemicals and water to create fractures in the rock so that oil can be extracted. Splitting open rock to access oil has allowed producers to extract billions of barrels of oil from the Bakken formation.

Despite it being around for decades (longer than horizontal wells!), key technological developments for this type of drilling continue to emerge. The focus is now on how to keep fractures open for longer (e.g., using more sand), so that more oil can be produced. SRC’s researchers are focusing on carbon dioxide (CO2) flooding, which could be well suited for extracting oil from the Bakken.

Knorr points out that, “The reservoir materials vary greatly across the large Bakken area, so finding where the CO2’s benefits are higher than the potential negative aspects will be a long term and ongoing research area for SRC’s Energy Division.” See the Bakken Breakthrough for more information on SRC’s work.

What’s Next in Drilling Trends?

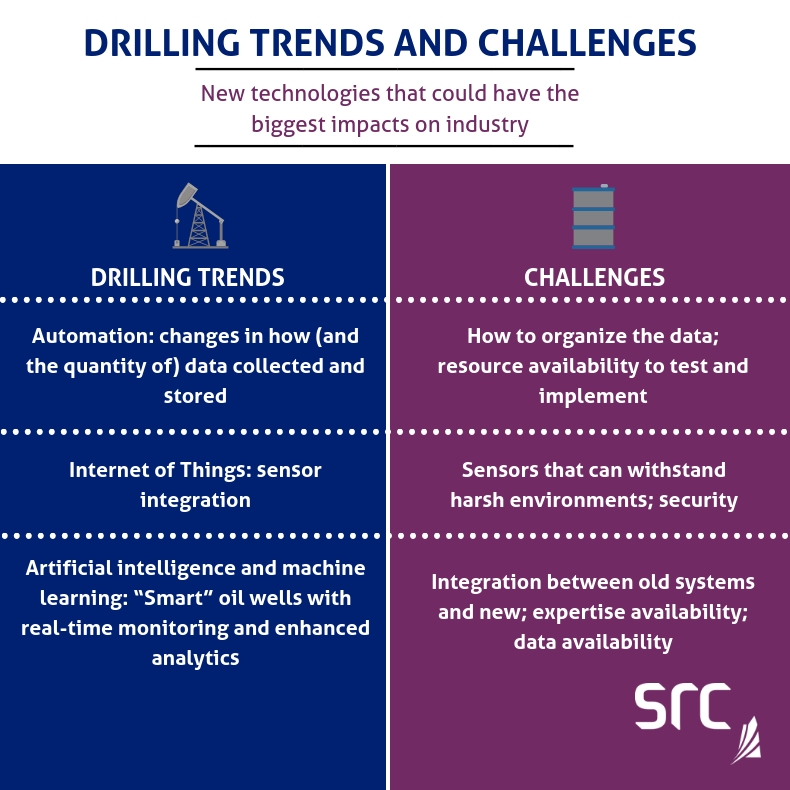

The above advancements in drilling have been largely physical. Technology systems that focus on more “cognizant” aspects of drilling could have the biggest impact on the industry in the future, changing how data is collected, analyzed and used. These technologies include automation, the internet of things, machine learning and artificial intelligence.

Drilling companies will continue to make inroads in developing “smart” oil wells, which include real-time monitoring and enhanced analytics. Communication and analytics will gain more importance in helping producers find and extract more oil, while spending less money and time doing it.

One example of this is a company using digital technologies is reducing the number of steps in its drilling process, as well as its decision-making processing, by half which is resulting in greater efficiencies in its operation.

Integrating digital technologies into operational systems requires data. As such, future achievements will be based on improved sensor technologies. Advanced drilling processes will require a variety of sensors to collect key information, which can then be analyzed.

But one of the first real challenges is organizing the data that is collected so that it can be effectively analyzed. “Many large oil companies are still trying to integrate the various platforms they use to collect and store data, and then they need the right systems to search and analyze it,” says Knorr.

Some industry analysts predict that the changes coming today could be adopted by oil companies faster than past technologies. Nonetheless, according to Knorr, it is likely that “field operations will continue to be improved through incremental innovation involving advancements in mechanical equipment and chemical process applications.” Much like it has throughout the past thirty years or so.

The value of those early developments, such as the first horizontal well being drilled in Saskatchewan three decades ago, cannot be overlooked. All it takes is someone to ask, “Can we do it?” And someone else to reply, “Why don’t we give it a try.”

The rest folks, is history.

This post was written by former SRC employee, Dwayne Pattison.